BTC Price Prediction: Navigating Consolidation Amidst Shifting Sentiment

#BTC

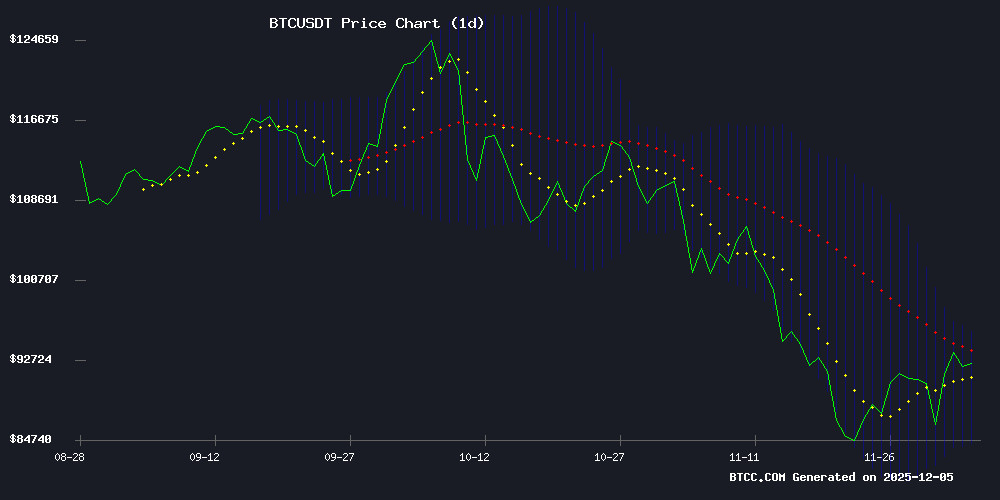

- Technical Crossroads: Bitcoin's price is consolidating below its 20-day moving average, with bearish MACD momentum. The key watchpoint is whether it can hold above the lower Bollinger Band ($84.3K) to avoid a deeper correction.

- Sentiment Dichotomy: Market headlines reveal a clash between short-term fear (capitulation, faded rally hopes) and long-term institutional conviction (large withdrawals, Wall Street interest, asset class framing).

- Investment Perspective: The current phase is characterized by high near-term volatility and uncertainty, making it challenging for short-term traders. However, the ongoing institutional adoption and evolving store-of-value narrative continue to underpin its long-term investment thesis for strategic portfolios.

BTC Price Prediction

Technical Analysis: BTC at Critical Juncture

As of December 6, 2025, Bitcoin is trading at $89,056.38, slightly below its 20-day moving average of $89,799.91. This positioning suggests a moment of equilibrium, where the price is testing a key support level. The MACD indicator, with a value of -3446.91, signals bearish momentum in the short term, as the signal line remains above the MACD line. However, the price is currently hovering near the middle Bollinger Band, which often acts as a dynamic support or resistance. A sustained hold above the lower band at $84,286.51 would be crucial to prevent a deeper correction. According to BTCC financial analyst Mia, 'The current technical setup shows BTC consolidating. A decisive break and close above the 20-day MA could reignite bullish momentum, while failure to hold the lower Bollinger Band may see a test of stronger support zones.'

Market Sentiment: A Mix of Fear and Long-Term Conviction

Current headlines paint a picture of a market in flux. News of bitcoin hovering near $89K with fading seasonal rally hopes and mentions of 'capitulation' among short-term holders point to negative short-term sentiment and potential fear. This is juxtaposed with significant institutional activity, such as Matrixport's large withdrawal from Binance and Wall Street's potential listing of a $4 billion Bitcoin firm, indicating underlying strategic accumulation. Furthermore, narratives around Bitcoin as an 'emerging savings asset class' from figures like Fidelity's CEO provide a counterweight of long-term fundamental belief. BTCC financial analyst Mia notes, 'The news flow reflects a classic tension between short-term panic and long-term institutional adoption. The market is digesting volatility while foundational players are positioning for the next phase.' This sentiment aligns with the technical view of a consolidation phase, where fear is present but not necessarily indicative of a broken long-term trend.

Factors Influencing BTC’s Price

Bitcoin Hovers Near $89K as Seasonal Rally Hopes Fade Amid Thin Liquidity

Bitcoin's attempt to sustain a Santa Claus rally falters as prices slip below $90,000, trading near $89,000 amid broad crypto market weakness. The Fear & Greed Index lingers at 25, reflecting persistent anxiety and fragile investor sentiment vulnerable to routine headlines.

Seasonal tailwinds fail to materialize as order book depth remains insufficient to absorb volatility. Tight spreads and rebuilt liquidity are prerequisites for any meaningful year-end rally—conditions currently absent in crypto markets. Derivatives markets show unstable footing, with erratic funding rates and flip-flopping futures basis indicating uncontrolled leverage resets.

The calendar effect alone cannot override structural weaknesses. For digital assets to capitalize on seasonal trends, sustained bid depth must emerge across global trading sessions—a scenario not evidenced in recent price action.

Matrixport Withdraws $352.5M in Bitcoin From Binance Amid Market Uncertainty

Bitcoin holds steady above $92,000 as institutional activity signals potential accumulation. Matrixport, a major Asian crypto financial services platform, moved 3,805 BTC off Binance—a transaction valued at $352.5 million. The withdrawal comes amid divergent analyst views on whether the recent rebound marks a relief rally or the start of a new bullish phase.

Market observers note large exchange outflows often precede long-term holding strategies. Founded by Bitmain co-founder Jihan Wu, Matrixport's MOVE adds complexity to a market grappling with mixed derivatives signals and spot market volatility. Bitcoin's resilience at current levels contrasts with lingering macro concerns about deeper corrections.

Wall Street to List $4 Billion Bitcoin Firm – Potential Impact on BTC's Trajectory

Twenty One Capital, a Bitcoin treasury firm holding approximately 43,500 BTC ($4 billion), is set to debut on the New York Stock Exchange under the ticker symbol XXI. The listing follows shareholder approval of its merger with Cantor Equity Partners, with trading expected to commence on December 9. The firm's substantial BTC holdings position it as the third-largest corporate Bitcoin holder, trailing only Strategy and MARA.

The move signals growing institutional adoption of Bitcoin, with Twenty One's backers including Tether, Bitfinex, Cantor Fitzgerald, and SoftBank. Market volatility persists as investors assess the long-term implications of such high-profile listings on Bitcoin's price trajectory.

Bitcoin’s Latest Drop Signals Capitulation, Not Just a Correction

Bitcoin's recent plunge below $90,000 wasn't merely a routine pullback—it bore the hallmarks of a full-scale capitulation event. On-chain analytics platform Alphractal identified three rare confluence signals suggesting panic selling, forced liquidations, and market dread reached a tipping point.

The hash rate fluctuation, often a precursor to miner surrender, joined other technical indicators flashing extreme stress. Such events historically precede trend reversals, making this a pivotal moment for BTC's short-term trajectory.

Bitcoin Short-Term Holders Capitulate at Levels Seen During FTX Crash

Bitcoin's recent price correction has triggered the largest wave of short-term holder capitulation since the 2022 FTX collapse. Glassnode data reveals these investors—who purchased BTC at higher prices—are now realizing losses at a scale comparable to post-FTX market conditions, though without a comparable liquidity shock.

The $80,000 support level became a breaking point for recent buyers, while long-term holders remain largely unfazed. Their average cost basis sits at $54,622, a historical high that underscores their advantage during volatility. Market analysts note such capitulation events often precede local bottoms, with BTC already rebounding to $94,000 before retracing to $92,000.

Notably absent are distressed sales from major institutions—a key distinction from the FTX aftermath. The market now watches whether this flush-out of weak hands sets the stage for renewed upward momentum, following historical patterns where extreme realized losses marked turning points.

Fidelity CEO Positions Bitcoin as Emerging Savings Asset Class

Fidelity Investments CEO Abigail Johnson has endorsed Bitcoin's role in modern portfolio construction, stating the cryptocurrency will establish itself in "the savings hierarchy." The $5 trillion asset manager's chief executive confirmed her personal BTC holdings during a December 5, 2025 statement that circulated across financial media.

Bitcoin's 15-year track record now challenges traditional savings vehicles. The cryptocurrency has outperformed dollar-denominated assets, tech equities, and commodities by orders of magnitude since its inception. While volatility remains a concern, BTC's appreciation has consistently outpaced inflation—a structural advantage Johnson implicitly highlighted.

Market observers note bitcoin maintains its position as crypto's gold standard despite ongoing asset proliferation. Grayscale researchers suggest the asset may be transitioning from a four-year to five-year market cycle, potentially delaying but not diminishing future price peaks.

Bitcoin's Slump Dashes $250K Price Dreams as Macro Winds Shift

Bitcoin's 33% plunge from its December high has vaporized bullish projections, including Arthur Hayes' $250,000 year-end target. The cryptocurrency now teeters NEAR $60,000 as ETF inflows slow and macro uncertainty lingers.

Market sentiment soured after the Federal Reserve's delayed pivot and shrinking dollar liquidity. 'The $250K calls assumed perpetual liquidity expansion,' noted Alexandr Kerya of CEX.io. 'Those catalysts have stalled.'

Though Bitcoin clawed back to $93,000 on hopes of Fed tightening cessation, the rally lacks conviction. Traders eye critical support at $60,000—a level that could trigger cascading liquidations.

Strategy’s Bitcoin Purchases Plummet in 2025 as Institutional Demand Shifts

Strategy, the Michael Saylor-led corporate Bitcoin buyer once seen as a bellwether for institutional demand, has dramatically scaled back its purchases this year. Monthly accumulations peaked at 134,000 BTC in late 2024 but collapsed to 9,100 BTC by November 2025—a 93% decline. December’s activity was nearly dormant, with just 135 BTC recorded in early trades.

The firm’s November 17 purchase of 8,178 BTC (worth $835 million at the time) marked its largest single buy since July, bringing total holdings to 649,870 BTC. Yet this outlier failed to offset the broader retreat. Market analysts now question whether institutional appetite is cooling or merely regrouping.

CryptoQuant data reveals the stark drop: from market-moving acquisitions to a trickle. The 24-month buffer suggests Strategy is bracing for bearish conditions, leaving traders to wonder who might fill the void.

Bitcoin Price Trajectory Hinges on Miner Resilience and Strategy’s Holdings

JPMorgan analysts highlight Bitcoin’s precarious balance between miner capitulation and corporate holding strategies. With production costs now estimated at $90,000—down from $94,000 last month—the asset trades near breakeven for high-cost miners. Electricity price fluctuations add $18,000 to costs per $0.01/kWh increase, squeezing margins.

China’s mining ban and global energy costs have triggered a 4.3% drop in network hashrate. Market attention shifts to Strategy’s Bitcoin reserves, where forced liquidation risks could amplify selling pressure. 'The $170K bullish case requires flawless balance sheet management,' notes analyst Nikolaos Panigirtzoglou.

Glassnode data reveals miner outflows accelerating as profitability crumbles. Bitcoin’s $92K price level tests the survival threshold for inefficient operators, creating a Darwinian shakeout.

Bitwise CIO Dismisses Notion of Forced Bitcoin Liquidation by Strategy

Bitwise Chief Investment Officer Matt Hougan challenges bearish speculation that Strategy (MSTR) could be compelled to sell its $60 billion bitcoin holdings. The debate stems from MSCI's potential reclassification of digital asset treasury companies (DATs), which might trigger index fund divestment. Hougan acknowledges the ambiguity, noting MSCI's historical exclusion of holding structures like REITs.

Michael Saylor maintains Strategy operates as a software company with bitcoin-linked financial engineering—a stance Hougan finds credible. The outcome hinges on whether MSCI views DATs as operating entities or investment vehicles. Market participants estimate up to $2.8 billion in forced selling if exclusion occurs, though Hougan considers this scenario overstated.

Malaysia Intensifies Crackdown on Illegal Bitcoin Mining, Seizes 14,000 Rigs Over $1B Power Theft

Malaysian authorities have launched a nationwide crackdown on illegal Bitcoin mining operations, seizing nearly 14,000 rigs linked to an estimated $1.1 billion in stolen electricity. The multi-agency task force, including Tenaga Nasional Berhad (TNB) and police, deployed drones with thermal cameras and ground teams to uncover illicit mining sites hidden in warehouses, shops, and residential areas.

Power theft tied to Bitcoin mining has surged 300% since 2018, with operators frequently relocating to evade detection. Meter tampering and unauthorized grid connections have become rampant, prompting aggressive raids and arrests. The scale of losses—RM 4.57 billion since 2020—underscores the growing strain on infrastructure from clandestine crypto operations.

Is BTC a good investment?

Based on the current technical and fundamental landscape, Bitcoin presents a complex but potentially rewarding investment case, suited for those with a clear strategy and risk tolerance.

Short-Term (1-3 months): Cautious. Technical indicators like the negative MACD and price action below the 20-day MA suggest ongoing consolidation or potential for further downside pressure. News of 'capitulation' and fading seasonal hopes reinforce near-term uncertainty. This period may be volatile.

Medium to Long-Term (6+ months): Constructive. The underlying fundamentals appear robust. Large institutional movements (e.g., Matrixport, Wall Street interest) signal professional capital deployment beyond short-term noise. The narrative of Bitcoin as a digital savings asset is gaining mainstream traction, which could support long-term valuation.

Key Data Snapshot:

| Metric | Value | Implication |

|---|---|---|

| Current Price | $89,056.38 | Testing key MA support |

| 20-Day MA | $89,799.91 | Immediate resistance level |

| Bollinger Lower Band | $84,286.51 | Critical support to watch |

| MACD | -3446.91 | Bearish short-term momentum |

As BTCC financial analyst Mia summarizes, 'Bitcoin is in a phase where weak hands are being shaken out, while strategic players are building positions. For investors, this environment calls for discipline—either through dollar-cost averaging to smooth entry points or waiting for a clearer technical breakout. It remains a compelling asset for portfolio diversification, but not without near-term risk.'